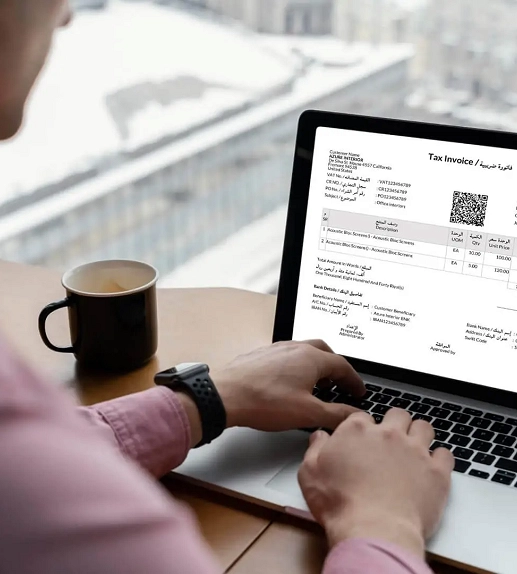

Saudi Arabia's new resolution aims that all VAT-registered businesses to transition from handwritten and paper invoices to electronic invoicing systems that are compatible with ZATCA's requirements.

Invoices must be created and transmitted electronically through the ZATCA platform to ensure tax compliance, accuracy, and transparency. The system allows for real-time tracking and reporting, simplifying financial operations for businesses and enhancing government oversight. Non-compliance may result in penalties or fines.

The first phase, referred to as the integration phase, marks a critical step in adopting the new e-invoicing system. Launched on December 4, 2021, this phase focuses on integrating the systems and processes businesses use with the ZATCA platform. Its primary objective is to ensure all invoices are generated and transmitted in compliance with ZATCA standards. While this phase is relatively lenient in terms of strictness, it sets the foundation for the more stringent requirements of the second phase.

The second phase, which was implemented on January 1, 2023, focuses on integrating taxpayers and other entities with the ZATCA e-invoicing portal. Taxpayers are informed of this phase six month prior to its implementation. This phase introduces advanced security features, such as cryptographic stamps (e-signature), UUID, and hash, to enhance invoice security. For B2B transactions, generating a QR code in XML format is now mandatory. Furthermore, all invoices must be uploaded to the e-invoice portal within 24 hours of being issued. Taxpayers must adhere to the technical and business requirements specified on the ZATCA website.

The Saudi Arabian government is implementing a law to tackle tax evasion and illegal activities by requiring ZATCA (The Zakat, Tax and Customs Authority) compatible e-invoicing software. ZATCA’s two-phase plan aims to enhance tax compliance for businesses. At Veuz Concepts, we build ZATCA-approved invoicing solutions using Odoo, ensuring your system meets all requirements for secure and efficient payment tracking. Our software is user-friendly and tailored to your needs, simplifying compliance, especially for Phase 2. Navigating ZATCA e-invoicing can be challenging, but we make it easy, helping you overcome technical and business hurdles effortlessly.

It's important to stay updated about Saudi's new e-invoice system. It is critical that you exercise thorough research for its applicability and thoroughly test it so that you do not run into any issues when the system is deployed. Our software of ZATCA e-invoicing in Saudi Arabia can be the perfect solution for your business. We don't just focus on the efficacy of the system but also your ease of use and other features that will be tailored to your requirement.